Office Worker's Recent Half-Year Experience in Learning and Practicing Fund Investment Portfolio

Contents

[NOTE] Updated October 8, 2023. This article may have outdated content or subject matter.

“Everyone should invest, the sooner the better. Even if you keep losing money, at least you will learn how to lose less after ten years. Instead of waiting until ten years later when you are forced to invest, you lose most of your principal at once” –@xiaodotdo

Preface

Because I stepped into work from school, I was actually a bit richer than when I was studying, and I was also quite frugal, so I had a lot of money left every month when I got paid. I felt that just saving it in the bank was a bit wasteful, so I took the opportunity to learn a lot about financial management during my work and did some practice in the fund market, and I want to share it with everyone as an experience.

There are risks in entering the market, investment needs to be cautious, the statements in this article do not constitute investment advice

Building Wealth Mindset

In February of this year, I watched a lot of videos and found that everyone was recommending a book “Rich Dad, Poor Dad”, so I downloaded it to my WeChat reading, and read a part of it every day after work. Slowly after reading this book, I found that my thinking was slowly changing, this book also gave me a lot of basic financial knowledge, I will summarize some of it below.

Need to understand the difference between “liabilities” and “assets”

The most important concept of this book is actually this, as a person who wants to absorb the knowledge of this book, you must also know this.

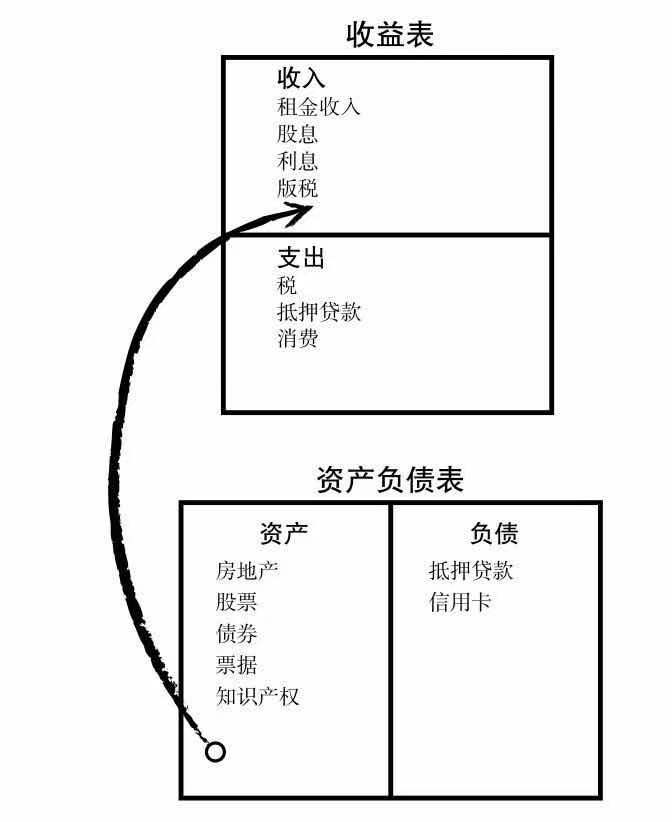

The so-called “liabilities” are those things that can take money out of your pocket.

The so-called “assets” are those things that can put money into your pocket.

Although these things seem simple, you need to understand. Let me give some examples here, many people before seeing this book would consider things like cars as assets, undoubtedly, in court liquidation, cars are indeed assets, but can your car bring you continuous money? Obviously most people can’t, cars need various maintenance, various maintenance. So in this book, cars are not “assets” but liabilities, similarly, things like credit cards that take money from you every month are also considered liabilities. So what counts as an asset? Let me give another example, if you buy a house in a very good location and rent it out at a high price, you can get a steady stream of rent every month, that is, this house can automatically put money into your pocket, then it can be considered your asset, similarly, if you rent out your car, use it as a wedding car for weddings, then this car is also your asset.

This might make you wonder why the rich get richer and the poor get poorer. As can be seen clearly from the figure below, the passive income from the assets of the rich can exceed their liabilities, meaning they can continue to invest the surplus of passive income into new assets, and as the assets increase, they become richer. The poor, on the other hand, oppress themselves with various mortgages and credit card bills, gradually becoming unable to make ends meet, let alone talk about assets.

Change your consumption concept

This book has a concept that I deeply agree with: “The poor always consume in advance, the rich always consume in arrears”.

This means that the poor always try to borrow money or consume as soon as they get their salary, but the rich will first convert their income into assets and let the assets earn money for them. When the assets have earned the money for the goods they need to consume, the rich will choose to consume.

This concept has also affected me. For example, I still want to buy a switch to play with, but I think this kind of thing will depreciate as soon as it is bought, and it is not very urgent for me, so for this product, I will consider consuming it after I have earned the money from my financial investment.

Lessons from domestic fund practice

Mutual funds entered the market in February

What is a mutual fund?

The concept of “diversifying risk” proposed by fund managers and financial planners, a collection of stocks, bonds, securities, and other forms of investment managed by professional investment companies. Private investors earn returns by buying shares. Owning shares in a mutual fund does not represent direct ownership of the corresponding company’s value.

In early February, the fund led by consumer goods Maotai grew wildly, attracting a group of leeks to enter the market. I also entered the market at that time. Because I didn’t know much about funds at that time, I invested some spare money in the fund.

Unexpectedly, February-March was brutal, falling worse day by day, completely different from what I had imagined. But I did do something right, which was to add some positions when it was close to the bottom.

Now it’s June, looking back and summarizing, I found that I made a mistake at that time, which was to choose to enter the market at a high point. Fortunately, it was spare money and I didn’t cut the meat. This is also the reason why most people lose money in the stock market.

That is, most investors want to make money in the stock market in the short term, and at the same time, they are hit by the weakness of human nature: buying funds when they are rising (wanting to make a big profit), and fearing more losses when they are falling sharply, they leave the market with tears.

Disadvantages of Mutual Funds

After investing for a while, I found that although mutual funds may bring you some returns, there are still some problems.

- Because mutual funds are managed by fund managers, who are also human, they may have fear and their own style of stock market operation. So, choosing a mutual fund is not about the fund, but about choosing the fund manager.

- If you don’t pay attention to the expense ratio and sales charges of mutual funds, they can get out of control.

- It also includes the common disadvantages of funds: poor trade execution. If you trade mutual funds at any time before the cut-off time of the net asset value of the mutual fund, the stocks you buy and sell on the mutual fund will get the same closing price net asset value.

Some Investment Gains

- Mutual funds need to be traded at 2-3 pm on trading days when buying and redeeming, because as mentioned above, you will get the net value of the closing price when trading between 10-3 pm on trading days. If you need to add positions when the fund falls sharply, you must choose to buy at 2-3 pm. Buying at night will be the net value of the next day (which may rise sharply the next day). PS: If the operation is not good, it is easy to lose a few points…

- Example: There is a fund of 50,000 yuan in a personal fund account, and the net value income of the day is 2.1. If a redemption application is submitted at 11:00 on the trading day, then the income of the fund [[redemption]] on the day needs to be calculated based on the net value of 2.1. Transactions after 15:00 will be calculated based on the next trading day.

- Don’t trade frequently, because the rate of mutual funds is actually quite high.

- Don’t check the market frequently. If you lose a lot of money, you can slowly add positions + don’t check the market frequently, and you can slowly get out of the predicament.

- Don’t put important money in, just put idle money.

April, Try Index Funds

After various twists and turns of stock funds, I started reading books about index funds. I found that index funds are also suitable for investment and are relatively easy to value.

Because stocks actually have their intrinsic value, the price of stocks actually fluctuates around their intrinsic value. So we need to value these index funds, buy when they are undervalued, and sell when they are overvalued.

For a company’s stock, if the company’s market value divided by the company’s annual profit (price-earnings ratio) is relatively small, it means that the company will earn a small part of itself every year, indicating that the company may be undervalued.

We often use PE (price-earnings ratio) for valuation, invest in index funds when PE is at a historical low, and sell when PE is at a historical high.

Trying Out the Four-Money Management in May

The Four-Money Management is a method of dividing your savings into four parts according to the time of financial management:

They are

Active Money Management, Steady Financial Management, Long-term Investment, and Insurance Protection.

For Active Money Management, I usually save it as 3 months' salary, which serves as a safety protection savings. When I suddenly lose a stable source of work, I can use this money. I set this money as current financial management, and I recommend using China Merchants Bank’s Morning Treasure, which has an annual yield of about 3%.

For Steady Financial Management, I usually invest in some bond funds, which are relatively stable, and the investment time is about 6 months to 3 years.

For Long-term Investment, I usually invest in products like mutual funds and stocks. This money is the one I probably won’t use, and it’s used for wealth accumulation and growth.

As for Insurance Protection, I haven’t gotten involved yet.

Then for the returns of these financial managements, if there are some profits, I will reward myself in ways like prizes (traveling, buying luxury goods). This money will be deducted from my non-appreciable savings.

Conclusion

To sum up the whole article, using the KISS principle, it’s actually about understanding the difference between liabilities and assets, accumulating more assets, making your passive income greater than your expenses, so that you can become richer and richer.

Author xiantang

LastMod 2023-10-08 (05461cf5)